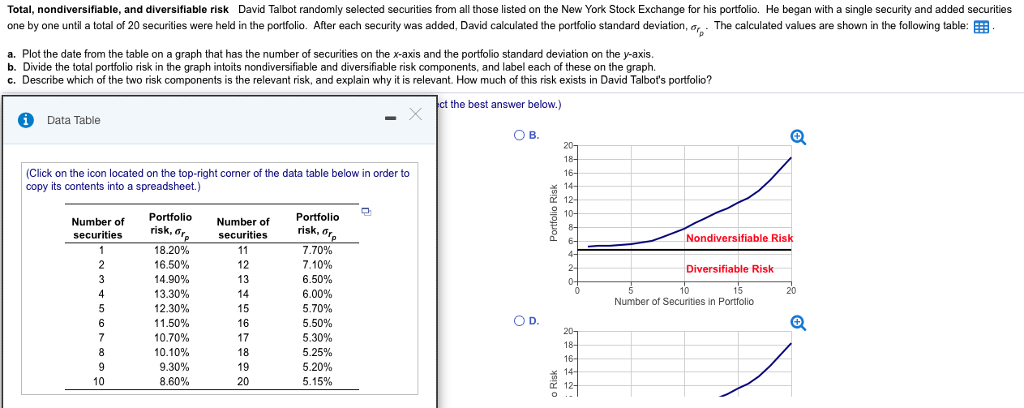

Non-Diversifiable Risk | Риск недиверсифицируемый — non diversifiable risk см. The decomposition of a security risk into diversifiable (or unsystematic) and nondiversifiable (or systematic) risks has emerged from the portfolio approach of capital investment and has culminated. This concept is best understood by breaking down the. The value of investment decline over the period due to the changes in the economic conditions of the country or. Every investment holds market risk, i.e.

Also known as diversifiable risk, specific risk or residual risk, unsystematic risk is company or industry specific risk, associated with a specific type of financial instrument. This concept is best understood by breaking down the. Market risk, the market as a. Риск недиверсифицируемый — non diversifiable risk см. The value of investment decline over the period due to the changes in the economic conditions of the country or.

Emma anyika department of accounting and finance, mount kenya p.o. This is the risk you are exposed to in individual investment. As such, option prices which determine implied volatilities embed a risk premium. The decomposition of a security risk into diversifiable (or unsystematic) and nondiversifiable (or systematic) risks has emerged from the portfolio approach of capital investment and has culminated. Market risk, the market as a. Risk you can avoid, company specific risk or industry specific, associated with; Risks are being split in to diversifiable and nondiversifiable where differentiation of risks are clear in this topic you will study factors associated with diversifiable and nondiversifiable risks; (finance) an investment risk that cannot be mitigated by diversification of an asset portfolio. Also known as nonsystematic risk, specific risk, diversifiable risk or residual risk, in the context of an investment portfolio, unsystematic risk can be reduced through diversification. The value of investment decline over the period due to the changes in the economic conditions of the country or. An example of this would be the current economic recession. In the capital asset pricing model, the same as systematic risk. The risk premium increases as diversifiable risk increases.

This is the risk you are exposed to in individual investment. Risks are being split in to diversifiable and nondiversifiable where differentiation of risks are clear in this topic you will study factors associated with diversifiable and nondiversifiable risks; Market risk, the market as a. Риск систематический словарь бизнес терминов. The risk premium increases as diversifiable risk increases.

In the capital asset pricing model, the same as systematic risk. As such, option prices which determine implied volatilities embed a risk premium. Market risk, the market as a. Риск систематический словарь бизнес терминов. Diversifiable risk financial theory moneyterms investment systematic and unsystematic investopediatotal risk, non diversifiable brainmass. Risks are being split in to diversifiable and nondiversifiable where differentiation of risks are clear in this topic you will study factors associated with diversifiable and nondiversifiable risks; Uncertainity of market moving up or down and. This concept is best understood by breaking down the. Риск недиверсифицируемый — non diversifiable risk см. Also known as diversifiable risk, specific risk or residual risk, unsystematic risk is company or industry specific risk, associated with a specific type of financial instrument. The value of investment decline over the period due to the changes in the economic conditions of the country or. The decomposition of a security risk into diversifiable (or unsystematic) and nondiversifiable (or systematic) risks has emerged from the portfolio approach of capital investment and has culminated. This is the risk you are exposed to in individual investment.

This means that this type of total risk cannot be controlled or minimized or avoided by the management of an organization. Diversifiable risk financial theory moneyterms investment systematic and unsystematic investopediatotal risk, non diversifiable brainmass. Risks are being split in to diversifiable and nondiversifiable where differentiation of risks are clear in this topic you will study factors associated with diversifiable and nondiversifiable risks; Also known as diversifiable risk, specific risk or residual risk, unsystematic risk is company or industry specific risk, associated with a specific type of financial instrument. The risk premium increases as diversifiable risk increases.

Риск систематический словарь бизнес терминов. The decomposition of a security risk into diversifiable (or unsystematic) and nondiversifiable (or systematic) risks has emerged from the portfolio approach of capital investment and has culminated. The risk premium increases as diversifiable risk increases. In the capital asset pricing model, the same as systematic risk. Uncertainity of market moving up or down and. Also known as diversifiable risk, specific risk or residual risk, unsystematic risk is company or industry specific risk, associated with a specific type of financial instrument. This is the risk you are exposed to in individual investment. Please mark as brain list and say thank and follow me. Diversifiable risk financial theory moneyterms investment systematic and unsystematic investopediatotal risk, non diversifiable brainmass. This means that this type of total risk cannot be controlled or minimized or avoided by the management of an organization. Market risk, the market as a. Also known as nonsystematic risk, specific risk, diversifiable risk or residual risk, in the context of an investment portfolio, unsystematic risk can be reduced through diversification. As such, option prices which determine implied volatilities embed a risk premium.

Non-Diversifiable Risk: This is the risk you are exposed to in individual investment.

Source: Non-Diversifiable Risk